The Valentine Gold Mine is in the Central Region of Newfoundland and Labrador, one of the top mining jurisdictions in the world. When completed, Valentine will be the largest gold mine in Atlantic Canada and a significant contributor to the economy of Newfoundland and Labrador.

Valentine comprises a series of mineralized deposits along a 20-kilometre trend. A December 2022 Feasibility Study outlined an open pit mining and conventional milling operation over a 14.3 year mine life with a 22% after-tax rate of return and an average gold production profile of 195,000 ounces of gold per year for the first 12 years. The Project has estimated Proven and Probable Mineral Reserves of 2.7 Moz (51.6 Mt at 1.62 g/t Au) and Mineral Resource Estimate for Total Measured and Indicated Mineral Resources (inclusive of the Mineral Reserves) of 3.96 Moz (64.62 Mt at 1.90 g/t Au). Additional Inferred Mineral Resources are 1.10 Moz (20.75 Mt at 1.65 g/t Au).

The Valentine Gold Mine is subject to regulation under the environmental protection regimes of the Canadian Environmental Assessment Act, 2012 and the Newfoundland and Labrador Environmental Protection Act. A project description was filed with both the Impact Assessment Agency (“IAA”, formerly the Canadian Environmental Assessment Agency) and the NL Department of Municipal Affairs and Environment (“NLDMAE”) on April 5, 2019, which was accepted into the formal Environmental Assessment (“EA”) process on April 16, 2019 and released from Environmental Assessment in August 2022. Both the IAA and the NLDMAE issued a determination requiring a project Environmental Impact Statement and guidelines have now been published by both parties.

In support of the EA process and the future development and operation of the Project, we are engaging in formal stakeholder engagement with the communities of Buchans, Buchans Junction, Millertown, Badger, Bishop’s Falls and Grand Falls-Windsor, Qalipu and Miawpukek First Nations and other interested parties.

Based on the Feasibility Study, we expect to employ an average of 405 persons during the project’s construction and 522 persons during operations, with $598M payable in federal and provincial income taxes, mining duties, at US$1700/oz gold.

Project Highlights

- Valentine Gold Mine in Central Newfoundland; World leading mining jurisdiction

- 100% ownership

- Largest Undeveloped Gold Resource in Atlantic Canada

- M&I 3.96 Moz (64.62 Mt at 1.90 g/t Au)

- Inferred 1.10 Moz (20.75 Mt at 1.65 g/t Au)

- December 2022 Feasibility Study

- After-tax 22% IRR & C$634 NPV5% at US $1700 Gold, C$463M Cost to Complete

- 14.3 Year Mine Life; 2.7 Moz Mineral Reserve; 195k oz/a Years 1 to 12

- Ongoing Exploration on 20km Mineralized Trend

- Focus on Sprite, Victory

Location Highlights

- Valentine is located in central Newfoundland

- Approximately 80km SW of the mining communities of Millertown and Buchans

- Road accessible

- NL Hydro substation at Star Lake 30km away

- Central Region with mine services and experienced workforce

- A mining region in a mining jurisdiction

Geology

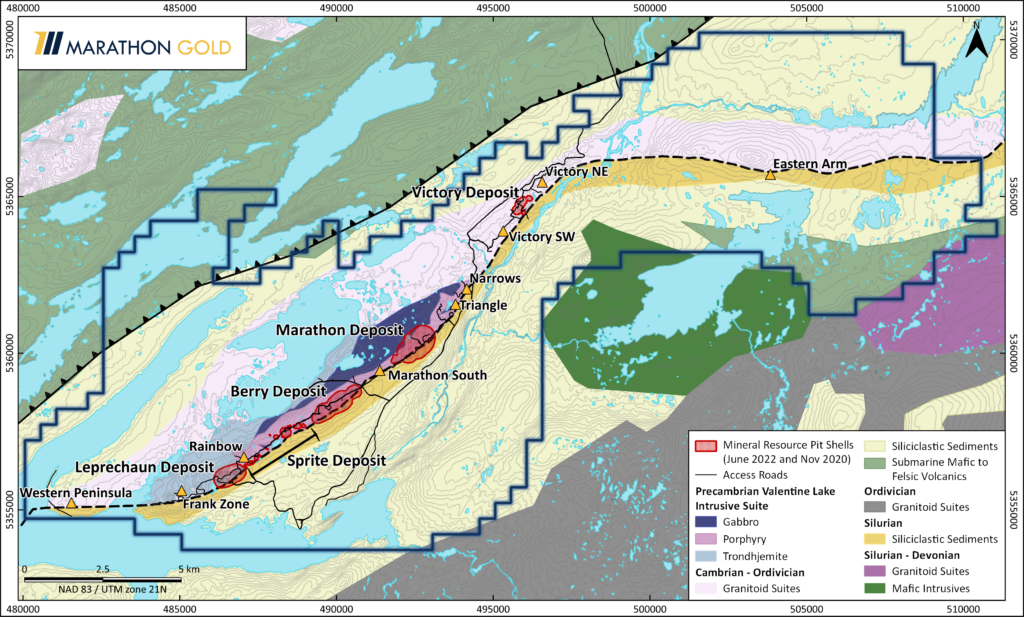

The Valentine Property hosts structurally controlled, orogenic-type gold bearing Quartz Tourmaline Pyrite (QTP) veins which occur along or proximal to the Valentine Lake Shear Zone which juxtaposed Precambrian rock of the Valentine Lake Intrusive Complex against the Silurian Rogerson Lake conglomerate.

The property is host to five gold deposits and multiple early stage exploration prospects along a 32-kilometre North-East, South-West trend. New resource updates for the Leprechaun and the Marathon Deposits were released in July 2022 while resource updates for the Sprite and Victory Deposits have effective dates of November 2020.

Multiple high potential prospects have been identified within Valentine, all of which are located along the Valentine Lake Shear Zone and include Frank Zone, Rainbow Zone, Triangle Zone, Victoria Bridge, Narrows, Victory SW, Victory NE and the Berry Zone.

The vein geometry consists of dominantly shallow southwest dipping, stacked en-echelon extensional veining and subordinate shear parallel steeply dipping fault filled veins. The QTP veins vary in thickness but are typically 2 to 30 cm thick with visible gold occurring as sub-millimetre to millimetre scale grains within or along the margins of coarse cubic pyrite and minor tellurides. Highest gold grades are commonly associated with large (1 to 3 cm) cubic pyrite within the QTP veining.

Metallurgy

Metallurgical Test Work

Metallurgical test work has been completed by SGS in Lakefield, Ontario and by Base Metallurgical Laboratories in Kamloops, British Columbia. The test programs have covered samples from the Marathon, Leprechaun, and Berry deposits and included chemical head analysis, comminution, metallurgical (gold recovery) and tailing detoxification testing. Test work examined two flowsheets. In the simpler flowsheet, to be used in a first phase of operations, the feed material is finely ground, coarse gold recovered by gravity concentration and intensively leached, and the gravity tailings separately leached. For the later phase of operations, the processing rate is increased, the grinding circuit is allowed to produce a coarser product, gravity concentration continues to be used, froth flotation is used to recover the bulk of the remaining gold with the concentrate finely ground and intensively leached, then further leached with the flotation tailings. The level of gold recovery from each flowsheet has been determined for samples ranging in gold feed grade from less than 0.5 g/t to greater than 5 g/t and grade-extraction recovery relationships developed for both flowsheets and the individual deposits.

Ore characterization included chemical head analysis on material from several geographical zones representing each of the Marathon, Berry and Leprechaun deposits. Samples were subjected to comminution testing, including SAG mill comminution (SMC) testing, Bond rod mill work index (RWi), ball mill work index (BWi), and abrasion index (Ai) tests. The comminution tests showed that all material behaved similarly and a suitable grinding circuit has been designed.

The gravity concentration process was applied to all of the samples tested to determine the expected level of coarse gold recovery. Additionally, the industry-standard Extended Gravity Recovery Gold (E-GRG) test was applied to nine composite samples from the three deposits to define equipment requirements and expected recovery levels which were in the range of 40 to 50% of feed gold. Intensive leach tests on gravity concentrate samples indicated 96% gold extraction or higher in a single pass with subsequent treatment increasing extraction from gravity concentrate to greater than 99%.

Gravity tailings from all samples were subjected to leach testing. Analysis of the data from the gravity recovery and leach tests led to development of gold feed grade-extraction relationships for the three different deposits. As an example, the relationship indicates that at a feed grade of 2 g/t, and processing approximately equal mixture of material from the three deposits, gold extraction is expected to be 94.0%. This is reduced to 93.0% recovery when allowance is made for soluble and other losses.

The Phase 2 circuit includes gravity concentration and leaching, flotation and intensive treatment of the flotation concentrate, and leaching of the flotation tailings. All of these were studied in detail and gold grade-extraction relationships were developed for this flowsheet. As an example, the relationship indicates that at a feed grade of 2 g/t gold extraction will be 96.7% which is reduced to 95.7% recovery after allowance for soluble losses.

Testwork also covered development of design data for tailings detoxification circuit, sizing data for tanks, pumps, thickeners and other equipment as needed for the detailed design of the process plant.

Other Projects

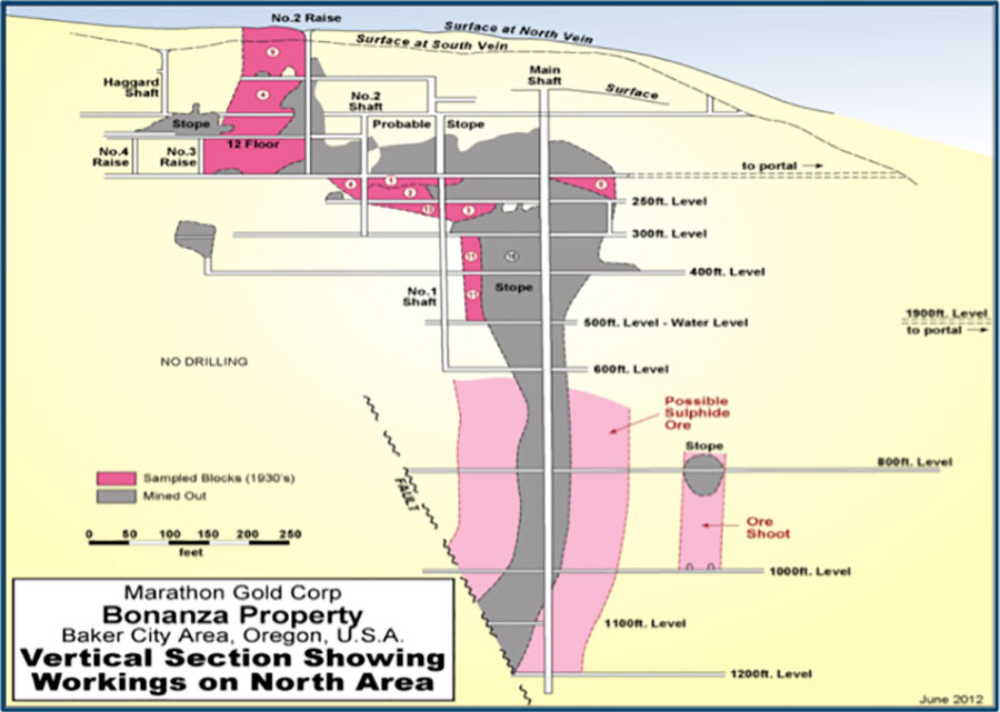

In addition to the Valentine Gold Mine in the Central Region of Newfoundland and Labrador, Calibre holds 100% interests in (i) the Bonanza Mine, a historic former mine located in Baker County in northeastern Oregon; (ii) the Gold Reef property, an exploration property consisting of approximately 12 hectares of claims located near Stewart, BC; and (iii) a 2% net smelter returns royalty on precious metal sales by the Golden Chest mine in Idaho.

100% Owned

Oregon, U.S.A.

- 100% Owned

- Historical producer in a historic mining district

- 128,500 tons grading 1.2 oz/ton and 99,900 oz Au was produced with an average recovery of 65%

- A historic mining cut off grade of 0.60 oz / ton (17 grams)

- The veins vary from a foot to 6 ft. wide and locally can be up to 30 ft. wide, dipping steeply to the southwest

- Large patented land package (300 acres)

- Low cost to maintain the project less than $20,000 per year

Click here to view the Micon International Bonanza Technical Report

Technical Reports

Environment